Postal Business: 8610 11185

Postal Savings: 8610 95580

Logistics and EMS: 8610 11183

China Post Life: 8610 4008909999

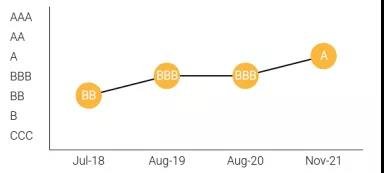

The Postal Savings Bank of China (PSBC) has recently received a rating of A in the latest 2021 Environment, Society and Governance (ESG) Ratings assessment released by Morgan Stanley Capital International (MSCI), taking the lead in China's banking sector.

|

|

PSBC's MSCI ESG Rating data rises from 2018 to 2021. Source: MSCI ESG Report |

ESG evaluates a company’s sustainability from the aspects of environment, society and corporate governance, and has increasingly become an important criterion in the capital market to measure the investment value of listed companies. MSCI ESG Ratings is one of the ESG rating systems widely recognized by global investment institutions. It conducts ratings on corporate governance, accessibility to finance, financing environmental impact, customer financial protection, privacy and data security, human capital development and other dimensions. It aims to measure a company's resilience to long-term, industry material environmental, social and governance (ESG) risks related to its operations and finance, and provide global investors with investment decision-making and data analysis basis.

As a dual-listed bank on A-share and H-share markets, PSBC attaches great importance to ESG management, practice and information disclosure, and continuously improves its sustainability and corporate transparency.

In terms of corporate governance, PSBC pushes ahead with the integration of ESG-related work into its development strategy, governance structure, corporate culture and business processes, upgrades management level, and creates sustainable business value together with its shareholders, customers, employees and people from all walks of life, striving to build itself into a responsible, resilient, customer-friendly first-class modern commercial bank.

In terms of accessibility to finance, the MSCI ESG rating report says PSBC focuses on supporting the underserved. Since its establishment, PSBC has always maintained its retail banking strategy, adhered to serving "Three Rural Issues" (agriculture, rural areas, and rural residents), urban and rural residents, and small and medium-sized enterprises, vigorously promoted the in-depth integration of finance and technology, actively explored the new mode and new ecology of inclusive finance, and blazed a path of PSBC-featured business sustainable development of inclusive finance.

In terms of inclusive financial systems and mechanisms, PSBC has set up responsibilities related to inclusive finance in the rules of the strategic planning committee of the Board of Directors to fully support the development of inclusive financial service. Statistics show that as of the end of September 2021, PSBC had nearly 40,000 outlets, serving more than 600 million individual customers. The balance of agriculture-related loans reached 1.58 trillion RMB (about 248.1 billion USD), accounting for about a quarter of all loans in the bank. This year, inclusive loans to small and micro enterprises exceeded 750 billion RMB (about 117.75 billion USD), serving more than 1.65 million customers, taking the lead in the banking industry. The balance of online small and micro loan products amounted to 662.844 billion RMB (about 104.066 billion USD), up 45% over the end of last year.

In terms of environment, PSBC has made great efforts to develop sustainable finance, green finance and climate financing, and strengthen biodiversity conservation, striving to build into a first-class green inclusive bank and a climate-friendly bank, and helping achieve the goals of carbon peaking and neutrality. This year, having officially adopted the Principles for Responsible Banking (PRB), and joined the United Nations Environment Program Finance Initiative (UNEP FI), PSBC is the second Chinese state-owned commercial bank signing PRB, and officially becomes a support organization of the Task Force on Climate-related Financial Disclosures (TCFD), so that it will further improve the quality of environment and climate related information disclosure. According to statistics, as of the end of September 2021, PSBC's green loan balance was 346.743 billion RMB (about 54.442 billion USD), up 23.42% over the end of last year.

The MSCI ESG Rating report also noted that PSBC has improved data security and talent management measures. In recent years, PSBC has continuously improved the mechanisms of consumer rights protection, and strengthened the framework centering on mechanisms such as decision-making and execution supervision, consumer rights protection review and related internal assessment, and information disclosure, thus effectively protecting customers' financial and personal information security, and continuously improving service quality. In terms of human capital development, PSBC has continuously intensified talent development and comprehensively strengthened the training of high-caliber personnel by promoting market-oriented talent selection, pushing forward the development of talent pool, and optimizing compensation management.

At the same time, PSBC attaches great importance to the ESG information disclosure. It prepares and releases Social Responsibility (Environment, Society and Governance) Report every year in accordance with the relevant disclosure requirements of the government, regulators, and Shanghai Stock Exchange and the Stock Exchange of Hongkong Ltd, and with reference to the international and domestic guidelines for preparation of sustainable development and social responsibility reports and relevant rating criteria. While meeting the requirements for disclosure in a rules-based way, it keeps improving the disclosure quality, thereby guiding the whole bank to continuously improve the level of ESG management and practice.

In June this year, J.P. Morgan issued a research report, which evaluated the ESG performance of China's banking industry through quantitative and qualitative evaluation methods, listed PSBC as one of the first ESG banks in China's banking sector, and fully recognized PSBC's leading position and key role in the field of inclusive finance.

As ESG philosophy is becoming an essential investment strategy in the capital market, ESG Ratings has turned an important basis to measure the investment value of listed companies. Professionals said that the leading ESG rating of PSBC by MSCI and J.P. Morgan reflects PSBC's continuous efforts in sustainable economic, environmental and social development, and can be regarded as a recognition of the capital market for PSBC's sustainability and long-term investment value.